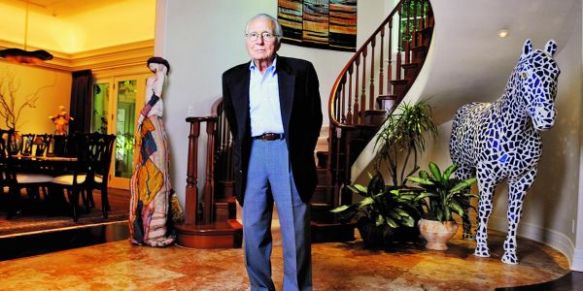

“Anne Beau Cox Chambers (b. 1919 in Dayton, Ohio) is an American media proprietor, who has a stake of interest in Cox Enterprises, a privately held media empire that includes newspapers, television, radio, cable television, and other businesses. She is the daughter of James M. Cox, a newspaper publisher and 1920 Democratic Presidential nominee. She owns and controls her father’s business interests, through Cox Enterprises.

Active in business and politics, Chambers was appointed ambassador to Belgium by U.S. president Jimmy Carter from 1977-81. She was a director of the board of the Coca-Cola Company during the 1980s, and she was the first woman in Atlanta to serve as a bank director (Fulton National Bank) and the first woman in Atlanta appointed to the board of the city’s chamber of commerce.

Chambers holds the Chair of Atlanta Newspapers and serves as a Director of Cox Enterprises, one of the largest diversified media companies in the US. It owns one of the nation’s largest cable television businesses, Cox Communications, which provides Internet and telephone; publishes newspapers including The Atlanta Journal-Constitution; and owns and operates broadcast television and radio stations.

Chambers is also a supporter of a wide range of cultural and educational charities, particularly in the arts and international affairs and has received many honorary doctorates and awards. She serves on the boards of the Atlanta Botanical Garden, the Atlanta Historical Society, and the Woodruff Arts Center, as well as on the boards of the Metropolitan Museum of Art, the Pasteur Foundation, and the Whitney Museum in New York. In 2005 the High Museum of Art named one of the wings of its expanded facility after Chambers in honor of her lifetime of support. In collaboration with the Louvre Museum in Paris, France, opened the exhibition “Louvre Atlanta”, in a partnership facilitated by Chambers.” [edited from Wikipedia]

Dear Mrs. Chambers:

I’m a musician, artist, and writer, and one of my current projects is called “Make an Artist a Millionaire.” The purpose is to collect and invest the million, enabling me to live off the interest and to achieve the ultimate goal: to pursue an art career without the need for a day job. The original method of the project was to get one million people to donate a dollar. The present phase of the project is to write letters to the members of the Forbes 400 list and solicit their help (in any amount). This phase is called “400 to 1,” an optimistic expression of my odds of success.

Your background, however, makes me optimistic that you would be receptive to the idea of an artist as a millionaire, and also aware of the irony in the name of this larger project. As not only a supporter of the arts but as a powerful woman who has surely had her share of challenges navigating a male-heavy business world, you may be familiar with the underdog culture of the arts.

This letter to you marks a departure from a simple, carefully-crafted fundraising proposal grounded in research into the personal background of the recipient. You and I, as businesswoman and artist respectively, have firm opinions based on wildly different sets of experience, but just because you are a billionaire doesn’t mean I know anything about you or what you think, any more than picking up one of Cox’s newspapers and simply holding it against my head would familiarize me with its contents.

So instead of a pitch, here is a set of questions. Starting with answers, in the form of letters, assumptions, etc. has not helped me become a millionaire or even made me any wiser. I’d rather hear what you think, learn from you, and see things from your perspective. Since we all know that artists should not be millionaires (joke), this project can at least get us closer to knowing why not.

Thank you for participating and I wish you a happy new year.

QUESTIONNAIRE

[In the following, “art” and “artist” are used in the broadest sense to describe visual artists, social practice artists, writers, musicians, filmmakers, etc.]

- To what extent should an artist’s ability to make a living on art depend on the quality of their work?

- To what extent should a person’s ability to make a living at their job depend on the quality of their work?

- Should artists be supported by individuals?

- Should artists be subsidized by the government?

- Do you purchase artwork and/or musical recordings? If so, in what media?

- What role should the marketplace play in an artist’s career?

- Please describe the relationship between the artist and the public.

- Is art a viable career? Why or why not?

- Is practicing art as a profession, without the safety net of a day job, gambling with one’s life and health?

- Is a piece of art or music a commodity? Why or why not?

- Is paying money out or foregoing compensation to expand the audience for one’s art an investment?

- In general, is art undervalued?

- Is art overvalued?

- What is artistic “genius”?

- At about what age should an artist give up the idea of making a living at art?

- At what age should a financial services professional do this?

- Should artists be trained in the way that doctors, teachers, lawyers, etc. are?

- If art were a business, would one be required to be licensed to practice it?

- If artists were a professional class, what kinds of individuals or organizations would their employers be?